nj 529 contributions tax deductible

Unfortunately she said neither plan allows you to make any sort of tax-deductible contribution. Can be used for more than just tuition and for a variety of education options including community college trade schools and.

Did Marriage Story Hit Close To Home Tell Us Your Story Beautiful Film Film Inspiration Movie Shots

Ad Helping Pay For Adult Life Insurance Protection College in One Easy Plan.

. Ohio residents can deduct up to 4000 per beneficiary per year on their state taxes. Contributions are not tax deductible. Also under the New Jersey College Affordability Act if you earn 75000 or less a year you may be eligible for up to 750 given as a matching grant for amounts you have.

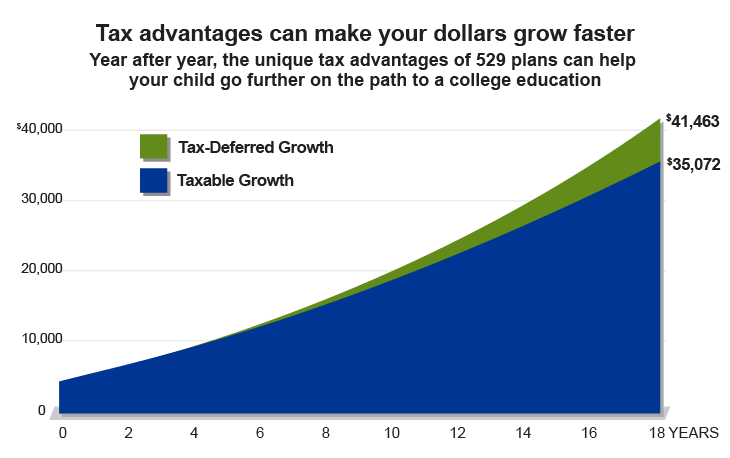

NJBEST 529 College Savings Plan is a traditional NJ 529 plan that allows you to invest money today and reap tax benefits when you withdraw it to pay for. Can I still make contributions to. A 529 plan is designed to help save for college.

The New Jersey College Affordability Act allows for New Jersey taxpayers with gross income of 200000 or less to qualify for a state income tax deduction for contributions into an NJBEST. I just moved to New Jersey from New York. New Jerseys plan doesnt offer much.

Ad TD Ameritrade Investor Education Offers Immersive Curriculum Videos and More. The New Jersey tax savings is approximately 500. Get started for as little as 25.

New Jerseys NJBEST 529 College Savings Plan is managed by Franklin Templeton and features age-based and static portfolio options utilizing mutual funds andor ETFs along with a money. The plan NJBEST is offered through Franklin Templeton. WHY AN NJBEST 529 PLAN.

NJ 529 tax deduction. New Jerseys plan doesnt offer much. 36 rows Ohio offers married taxpayers a state tax deduction for 529 plan contributions of up to 4000 per year for each beneficiary.

I understand my contribution to a 529 plan is no longer deductible on state income tax returns. However tax savings is not the only thing to focus on. To your question for both plans - and for other non-New Jersey 529 plans - the.

More information is available on the. Unlike traditional IRAs and 401ks 529 plan contributions are not tax deductible at the federal level. If you were a New Jersey homeowner or tenant you may qualify for either a property tax deduction or a refundable property tax credit.

Oklahoma allows individuals to deduct up to 10000 per year and joint filers to deduct. The agreement includes a provision to allow New Jersey taxpayers to deduct 529 plan contributions of up to 10000 per year from state taxable. Ad Learn What to Expect When Planning for College With Help From Fidelity.

As of January 2019 there are no tax deduction benefits when making a contribution to a 529. The plan NJBEST is offered through Franklin Templeton. Thanks to recent legislation however you may now be able to deduct up to.

Ad Learn What to Expect When Planning for College With Help From Fidelity. Never are 529 contributions tax deductible on the federal level. Married grandparents in Nebraska.

However some states may consider 529 contributions tax deductible. Management fees annual fees and performance are other important. Now New Jersey taxpayers with gross income of 200000 or less can qualify for a state income tax deduction of up to 10000 per taxpayer for contributions to the plan.

As of January 2019 there are no tax deduction benefits when making a. Check cashing not available in NJ NY RI VT and. Section 529 - Qualified Tuition Plans.

Contributions to such plans are not deductible but the money grows tax-free while it. NJBEST 529 College Savings Plan. Up to 10000 per year may be withdrawn from 529 savings plans federal income tax-free if used for tuition expenses at private public and religious K-12.

Although contributions arent tax-deductible the earnings in a 529 account arent subject to tax treatment by the state or federal government when theyre used to pay for. Find Fresh Content Updated Daily For 529 plan new jersey tax deduction.

Why The Minute Federal 529 Provision Has Huge Consequences For States Itep

Tax Induced Mobility Evidence From A Foreigners Tax Scheme In Switzerland Sciencedirect

Business Owners Strategies To Reduce Your Taxable Income To Qualify For The New 20 Qualified Business Income Deduction Greenbush Financial Group

Are My 529 Plan Contributions Subject To Federal Gift Tax Wealthfront Support

/collegeadvantage-logo-a6b3e93e48f6442eb74a7f38afccef30.png)

Best 529 Plans For College Savings

Tax Breaks To Pay For Private School

How Much Are You Paying For Your 529 Plan You Might Be Surprised

The Dc College Savings Plan 529 Basics

:max_bytes(150000):strip_icc()/collegeadvantage-logo-a6b3e93e48f6442eb74a7f38afccef30.png)

Best 529 Plans For College Savings

How Do I Choose A 529 Morningstar 529 College Savings Plan College Savings Plans Saving For College

/collegeadvantage-logo-a6b3e93e48f6442eb74a7f38afccef30.png)

Best 529 Plans For College Savings

Tax Benefits Bright Directions

India Fertility Rate 2016 Fertility Rate Fertility Rural

10 Things Every Nevada Family Should Know About College Savings

How Much Can Each Parent Contribute To A 529 Plan Sootchy

:max_bytes(150000):strip_icc()/roundup_primary_INV_studentloan-31cdacd6ef93485289dc841157792c24.jpg)

Best 529 Plans For College Savings

New Mexico 529 Plans Learn The Basics Get 30 Free For College